In the third quarter, digital sales made up 37% of the total; however, in-store sales grew 22% faster than they did the year before. Chipotle’s Stock continued expansion depends on this diverse blend.

Unlike many of its competitors, Chipotle Stock is in a strong financial position and can afford to keep making investments in growth. The company has a Piotroski F-Score of 6 out of 9, a 4,894 percent interest coverage ratio, and a 7 out of 10 GuruFocus financial strength rating overall.

Is Chipotle (CMG) a Good Stock?

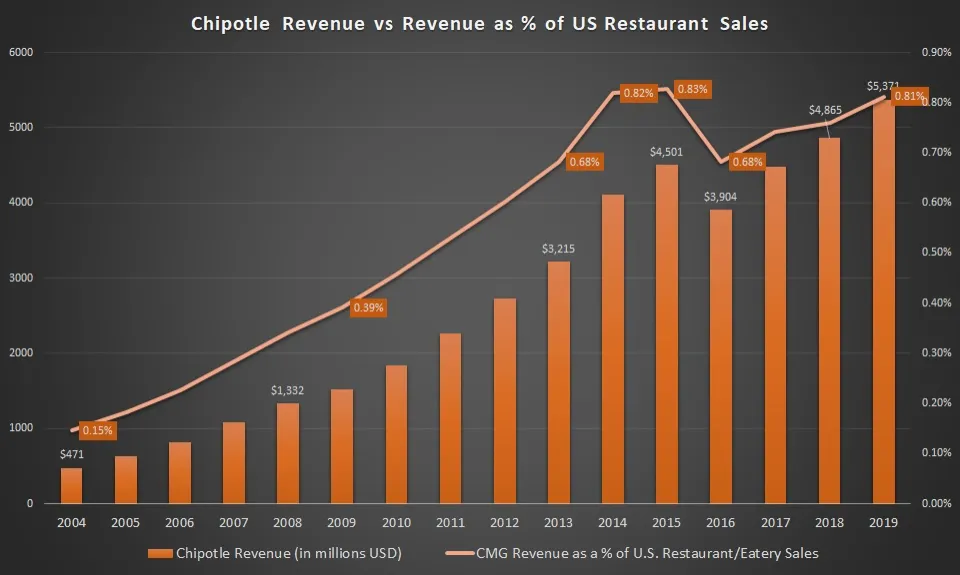

Chipotle has shown consistent growth in recent years, with increasing revenue and earnings per share. The company has also been expanding its digital capabilities, which has helped it to remain competitive in the evolving restaurant industry.

However, like any stock, there are risks associated with investing in Chipotle. For example, the restaurant industry is highly competitive, and consumer preferences can shift quickly. Additionally, supply chain disruptions, labor shortages, and other unforeseen events could impact the company’s performance.

Ultimately, whether or not Chipotle is a good stock depends on your investment goals, risk tolerance, and other personal factors. It’s important to do your own research and consult with a financial advisor before making any investment decisions.

Also Read: Is The Stock Market Going to Crash In 2023

What Was Chipotle IPO Price?

Chipotle Mexican Grill (CMG) went public on January 26, 2006, with an initial public offering (IPO) price of $22 per share. The IPO was considered successful, as the stock price nearly doubled on the first day of trading, closing at $44 per share. Since then, the stock has experienced significant growth, with the current price as of my knowledge cutoff date (September 2021) being over $1,700 per share. It’s worth noting that past performance is not a guarantee of future results, and investing in any stock carries risks.

Check More Stocks Information in BtcAdv Blog!

Is Chipotle Stock Overvalued?

The valuation of a stock can be assessed in different ways, but one common metric is the price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share (EPS). A high P/E ratio could suggest that the stock is overvalued, while a low P/E ratio could suggest that the stock is undervalued.

As of my knowledge cutoff date (September 2021), Chipotle’s P/E ratio was around 90, which is relatively high compared to the broader market average. However, it’s worth noting that high-growth companies like Chipotle often have higher P/E ratios than slower-growth companies, as investors may be willing to pay a premium for the potential for future earnings growth.

Other factors that could impact Chipotle’s valuation include its financial performance, industry trends, competitive landscape, and global economic conditions. It’s important to do your own research, consider your investment goals and risk tolerance, and consult with a financial advisor before making any investment decisions.

What is Return on Capital Employed (ROCE)?

Return on Capital Employed (ROCE) is a financial ratio that measures how efficiently a company is using its capital to generate profits. It is calculated by dividing the earnings before interest and taxes (EBIT) by the capital employed, which is the total amount of capital invested in the business.

The formula for ROCE is:

ROCE = EBIT / Capital Employed

ROCE measures the return that a company is earning on the total amount of capital employed in the business, which includes both equity and debt. This makes it a useful metric for evaluating the overall efficiency of a company’s capital allocation.

A high ROCE indicates that a company is generating strong profits relative to the amount of capital invested in the business. This can be a positive signal to investors, as it suggests that the company is using its capital effectively to generate returns.

However, it’s important to consider ROCE in the context of the industry and the company’s business model. Some industries require more capital investment than others, which can impact ROCE. Additionally, a high ROCE may not necessarily be sustainable in the long term, as business conditions can change over time.

Why is Chipotle Stock So High: the Bottom Line

The price of a stock is determined by a variety of factors, including the financial performance of the underlying company, investor sentiment, and broader economic conditions. In the case of Chipotle Mexican Grill (CMG), there are several reasons why the stock has been performing well in recent years:

- Strong financial performance: Chipotle has consistently delivered strong financial results, with increasing revenue, earnings, and comparable restaurant sales. The company has also been expanding its store count and growing its digital sales channels, which has helped to drive growth.

- High-growth potential: Chipotle is a high-growth company that has continued to expand both domestically and internationally. The company has a strong brand and a loyal customer base, which has helped to support its growth.

- Premiumization of fast-casual dining: The fast-casual dining segment, which Chipotle is a part of, has been growing in popularity in recent years. Consumers are increasingly willing to pay a premium for higher-quality, healthier, and more sustainable food options, which has benefited Chipotle.

- Positive investor sentiment: Investor sentiment has been positive towards Chipotle in recent years, with many analysts and investors bullish on the company’s growth prospects. This has helped to support the stock price.

It’s important to note that investing in any stock carries risks, and past performance is not a guarantee of future results. As with any investment decision, it’s important to do your own research, consider your investment goals and risk tolerance, and consult with a financial advisor before making any investment decisions.

FAQs

Why is Chipotle a Good Stock to Invest In?

It’s important to note that investing in any stock carries risks, and past performance is not a guarantee of future results. As with any investment decision, it’s important to do your own research, consider your investment goals and risk tolerance, and consult with a financial advisor before making any investment decisions.

Is Chipotle a Good Company to Invest In?

Like any investment, there are risks to investing in Chipotle. For example, the company may face increased competition or supply chain disruptions that could impact its financial performance. Additionally, the current high valuation of the stock could make it vulnerable to a market correction or a decrease in investor sentiment.

Ultimately, whether or not Chipotle is a good company to invest in depends on your individual investment goals and risk tolerance. It’s important to do your own research, consider your investment goals, and consult with a financial advisor before making any investment decisions.

How High Will Chipotle Stock Go?

It’s important to note that investing in any stock carries risks, and past performance is not a guarantee of future results. As with any investment decision, it’s important to do your own research, consider your investment goals and risk tolerance, and consult with a financial advisor before making any investment decisions.

Investors should always approach stock price predictions with caution, as no one can predict the future with certainty. It’s best to focus on investing in companies with strong fundamentals, a solid track record, and a clear growth strategy, rather than trying to make predictions about short-term stock price movements.